“Returning from the ocean hazards to the protection of a sheltered bay” – Shinnecock Inlet, Long Island, NY

EXPERIENCED

Shinnecock Partners is a family office investment boutique, founded in 1989, specializing in alternative investments and fund of funds portfolios. The firm’s principals have worked together for over 30 years.

DEDICATED

Shinnecock combines deep domain knowledge, in-depth analysis and proprietary quantitative tools along with rigorous due diligence to produce the best risk-adjusted performance for our clients.

PROFESSIONAL

Shinnecock is supported by a talented staff and “blue chip” service providers:

SS&C Globe Op (administration)

Spicer Jeffries (audit and tax)

Our Team

Alan is the Founder and Managing Partner of Shinnecock Partners. Alan was the Founder, CEO, President, and Chairman of the Board of Answer Financial Inc. and Insurance Answer Center, CEO of Aurora National Life Assurance, President/COO of First Executive Corporation and Executive Vice President and Board Member at Dean Witter Financial Services Group (predecessor to Morgan Stanley), where he formulated the launch of the Discover Card as a member of a three-person team. He is also the former Chairman, President and Board Member of the Western Los Angeles Boy Scout Council. Alan is a graduate of Georgetown University and Harvard Business School, where he was a Baker Scholar.

Joel began his association with Shinnecock Partners in 1992 as a consultant, creating proprietary computer software for portfolio modeling and comparative evaluation of money managers. Joel traded a private futures account from 1994 to 2003, for which he developed and implemented a number of computerized trading systems. He joined Shinnecock full-time in 1998 as Principal and is in charge of day-to-day administrative, accounting and investor relations areas. He continues to create custom software applications and works jointly with Alan Snyder on the management of the funds’ portfolios. Joel is a graduate of Columbia College.

Christian works with the principals in sourcing, evaluation and due diligence of prospective money managers, as well as the ongoing management of the funds’ portfolios. Christian is a graduate of Boston College, and is currently pursuing his Chartered Alternative Investment Analyst designation.

Michael’s responsibilities include assisting with money manager monitoring and evaluation, marketing and operations. Prior to joining Shinnecock, Michael was an analyst in the Healthcare Practice at Huron Consulting Group where he worked on revenue cycle management and performance improvement at multiple hospitals and health systems. Michael graduated from Duke University with a B.S.E. in Mechanical Engineering.

David serves as an analyst for Shinnecock’s Art Lending Fund, assisting with due diligence and monitoring the fund’s portfolio of fine art collateral. Prior to joining Shinnecock, David worked for several fine art galleries in Los Angeles and has experience in art history and inventory management. David graduated cum laude from Loyola Marymount University with a degree in Studio Art and Art History.

Kim joined Shinnecock as Office Manager in 2013. Prior to Shinnecock, she was an independent general business consultant and multimedia specialist with experience in broadcast, digital and print media. Kim holds an MBA from California State University, Los Angeles and serves on the board of directors for the Alumni Association after serving two years on the financial oversight committee.

Click to view all team members

Art Lending Fund LLC (“ALF”)

Art Lending Fund LLC (“ALF”)

A diversified portfolio of loans secured by fine art, offering:

Borrowers interested in fine art loans, please click here: Art-Secured Loans

What is Art-Secured Lending?

Fine art-secured lending is “hard asset” lending against museum-quality, auction-worthy art

(e.g. Sotheby’s, Christie’s, Phillips, Bonhams)

Art dealers and collectors borrow against their art to:

Taking out a loan instead of selling individual artworks allows borrowers to:

Investment Terms & Service Providers

| Launch Date | May 1, 2019 | |

| Structure | Delaware limited liability company | |

| Target Net Return | 7% – 8% net unlevered return | |

| Management Fee | 1% | |

| Incentive Fee | 10%, subject to high water mark | |

| Minimum Capital Commitment | $100,000* | |

| Redemptions | Quarterly after one-year lock, with 90 days’ notice | |

| Investor Qualifications | Accredited Investor | |

| Auditor | Spicer Jeffries LLP | |

| Administrator | SS&C GlobeOp | |

| Cash Custodian | First Republic Bank | |

| General Counsel | Faegre Baker Daniels LLP / Buchalter PC / Paul Hastings LLP |

*ALF uses a capital call structure in order to balance cash inflows against investable loans and other cash needs. ALF may call any portion of an investor’s capital commitment at any time with reasonable prior notice within six months of the initial commitment date. If after six months the total amount committed has not been called, the remaining commitment amount is released.

Available to taxable, tax deferred and tax-exempt investors, U.S. or offshore

This information is for discussion purposes only and does not constitute an offer to sell or a solicitation of an offer to buy an interest in Art Lending Fund LLC (“ALF”). Any offer to sell or solicitation of an offer to buy an interest in ALF may be made only by the delivery of ALF’s Confidential Private Placement Memorandum (the “Memorandum”) specifically addressed to the recipient thereof. In the event that the terms of this document and the Memorandum are conflicting, the Memorandum’s terms shall control. You must be an “accredited investor” to receive a copy of the Memorandum, but only investors that meet all of ALF’s investor suitability requirements will be allowed to invest.

The limited liability company membership interests in ALF are speculative securities and their purchase involves a high degree of risk. You should consider all risk factors set forth in the Memorandum before investing in ALF. Specifically, you should be aware that:

“The Cat That Got the Cream: Digesting a Resurging Art Market” – David Toma (May 5, 2022)

“A Safe Haven: Art Lending” – Alan Snyder (March 13, 2020)

“Shinnecock Art Lending Report Card” – Alan Snyder (March 4, 2021)

“What, Me Worry?” – Alan Snyder (July 16, 2020)

“Paraprosdokians = Lockdown Madness” – Alan Snyder (May 20, 2020)

“7%+ Net, 6 Months Duration, No Leverage, Hard Asset… STINKS” – Alan Snyder (November 12, 2019)

“9 Catchers Ain’t Moneyball” – Alan Snyder (November 4, 2019)

“Jointness + Resilience: Critical Portfolio Neologisms” – Alan Snyder (September 11, 2019)

“Less Barking, More Tail Wagging from Art Market Facts” – Michael Cervino (April 5, 2019)

“Verifying the V in LTV” – Alan Snyder (February 20, 2019)

“Chevrolet and Monet” – Michael Cervino (February 13, 2019)

“Fine Art & Wine: The Golden Girls of 2018” – Michael Cervino (January 16, 2019)

“Who Ya Gonna Call? An Opportunity!” – Alan Snyder (December 12, 2018)

Hedge Connection – In the Den with Lisa Vioni – Alan Snyder April 24, 2020 |

|

Shinnecock Partners Launches Art Lending Portal

Press Release, September 19, 2019

How the Rich Get Spending Money: Locking Fine Art in Storage and Borrowing Against It

Los Angeles Times, August 1, 2019

Shinnecock Partners Launches Alternative Fine Art Lending Fund

Press Release, May 29, 2019

Family Office Pitches Art Loan Fund

Hedge Fund Alert, May 29, 2019

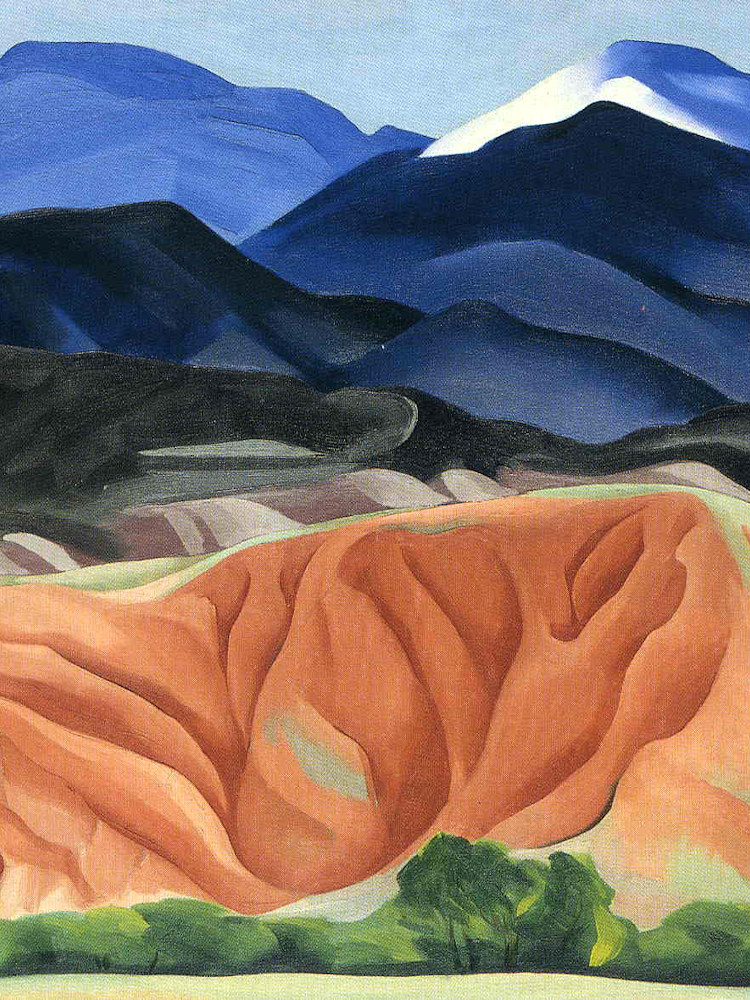

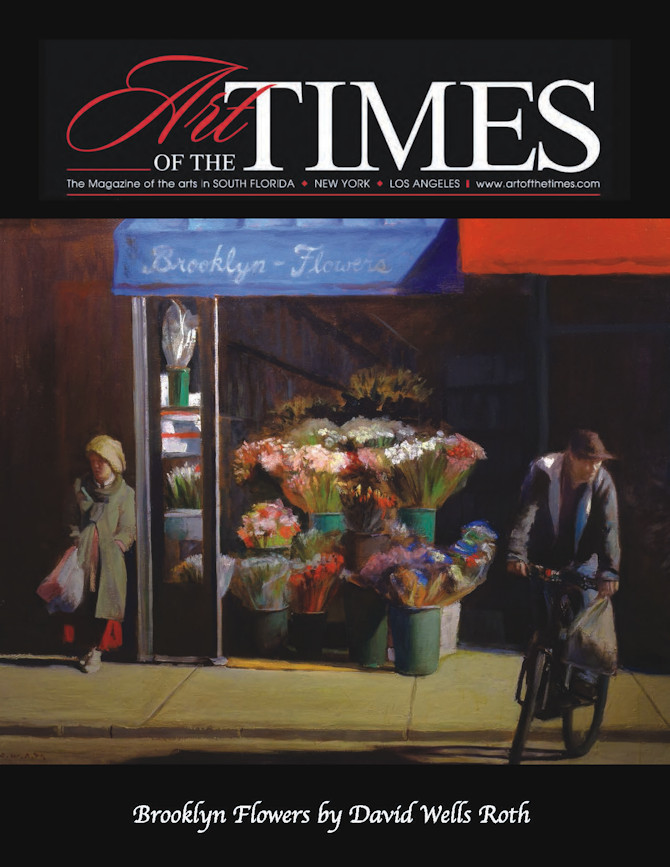

Investing in Art-Secured Lending

Art of the Times, Fall 2018

Upcoming Events

March 11 – 12, 2024 – Austin, TX + Virtual

IvyFON: Family Office 2024 Trends

Jackson Walker

100 Congress Avenue, Suite 1100

Austin, TX 78701

(Virtual/Zoom option available at no cost)

Alan Snyder speaking on 3/11, 10:00am – 10:25am

Information & Registration

Articles & Research

“The Cat That Got the Cream Redux”

– David Toma

December 29, 2022

“A Transformative Investment – Please Watch the Video”

– Alan Snyder

August 29, 2022

“The Cat That Got the Cream: Digesting a Resurging Art Market”

– David Toma

May 5, 2022

“A Safe Haven: Art Lending”

– Alan Snyder and David Toma

December 8, 2021

“Eggcorn and Inflation Misunderstandings”

– Alan Snyder

September 13, 2021

“NFTs – Caveat Emptor”

– Alan Snyder

July 8, 2021

“The Cat That Got the Cream Redux”

– David Toma

December 29, 2022

“A Safe Haven: Art Lending”

– Alan Snyder and David Toma

December 8, 2021

“Shinnecock Art Lending Report Card”

– Alan Snyder

March 4, 2021

“What, Me Worry?”

– Alan Snyder

July 16, 2020

“Paraprosdokians = Lockdown Madness”

– Alan Snyder

May 20, 2020

“7%+ Net, 6 Months Duration, No Leverage, Hard Asset… STINKS”

– Alan Snyder

November 12, 2019

“9 Catchers Ain’t Moneyball”

– Alan Snyder

November 4, 2019

“Jointness + Resilience: Critical Portfolio Neologisms”

– Alan Snyder

September 11, 2019

“Less Barking, More Tail Wagging from Art Market Facts”

– Michael Cervino

April 5, 2019

“Verifying the V in LTV”

– Alan Snyder

February 20, 2019

“Chevrolet and Monet”

– Michael Cervino

February 13, 2019

“Fine Art & Wine: The Golden Girls of 2018”

– Michael Cervino

January 16, 2019

“Who Ya Gonna Call? An Opportunity!”

– Alan Snyder

December 12, 2018

“Bang, Oops, Another Down”

– Alan Snyder

October 30, 2018

“One Good Thing About Being Wrong Is the Joy It Bring Others”

– Alan Snyder

August 8, 2018

“Water, Water Everywhere, but Not a Drop to Drink”

– Alan Snyder

June 6, 2018

“Alt Lending Loses Its Mojo”

– Alan Snyder

August 4, 2017

“Truth Hurts”

– Alan Snyder

July 21, 2017

“An Artichoke Moment”

– Alan Snyder

January 19, 2017

“Fish Tacos and Alternative Lending”

– Alan Snyder

October 6, 2016

“Erratifluxis”

– Alan Snyder

September 14, 2016

“Good Things Come in Small Packages”

– Alan Snyder

August 19, 2016

“Only Loss Teaches Us the Value of Things”

– Alan Snyder

July 12, 2016

“Poof! Alternative Lending is Gone”

– Alan Snyder

June 22, 2016

“Zebra Commentary”

– Alan Snyder

May 13, 2016

“Goldilocks, The Three Bears and Our Search for Yield”

– Alan Snyder

May 5, 2016

“We Owe You a Major Apology”

– Alan Snyder

April 29, 2016

“Get Sexy with Alternative Lending”

– Alan Snyder

April 7, 2016

“Should Investors Assume the Fetal Position by Going to Cash?”

– Alan Snyder

March 29, 2016

“Traditional Banks Join the Alt-Lending Fray”

– Alan Snyder

February 3, 2016

“Moody’s Analyzes Marketplace Lending”

– Alan Snyder

January 14, 2016

“Alternative Lending Risk Analysis”

– Alan Snyder

December 30, 2015

“Yield Scorecard”

– Alan Snyder

December 17, 2015

“A Transformative Investment – Please Watch the Video”

– Alan Snyder

August 29, 2022

“NFTs – Caveat Emptor”

– Alan Snyder

July 8, 2021

“Are You That Financial Doubting Thomas?”

– Alan Snyder

December 20, 2017

“Life Settlements: Impact Investing with House Odds or Trafficking in Tragedy?”

– Alan Snyder

June 10, 2016

“Investing in Commodities and Futures without Losing Your Pants or Skirt”

– Alan Snyder

October 11, 2010

“Disambiguating Bernie Madoff” [fraud lessons to be learned]

– Alan Snyder

“Curiosity Killed the Cat – Addressable Market for Hedge Fund and Alternative Information” [the market]

– Alan Snyder

“Investment Answers from the Gnomes of Zurich” [getting started]

– Alan Snyder

Healthcare Professionals Homepage

“Lighter Fare but Possible Homework (ha)” [sources for basic Alternatives knowledge]

– Alan Snyder

“Trust, The Critical Investment Appurtenance”

– Alan Snyder

“7%+ Net, 6 Months Duration, No Leverage, Hard Asset… STINKS” [return expectations]

– Alan Snyder

“Water, Water Everywhere, but Not a Drop to Drink” [finding the best investments]

– Alan Snyder

“Mirror, Mirror on the Wall” [due diligence starting point]

– Alan Snyder

“What’s Your Edge?”

– Alan Snyder

“Ten Reasons Not to Phone it In and One to Smile” [onsite due diligence]

– Alan Snyder

“Bright Shiny Objects, All That Glitters Isn’t Gold, and Lessons Learned from Richard Cory” [lessons to be learned from the past]

– Alan Snyder

“Building a Portfolio, Due Diligence and Les Trois Mousquetaires” [more lessons to be learned from the past]

– Alan Snyder

“Eggcorn and Inflation Misunderstandings”

– Alan Snyder

September 13, 2021

“Why Did I Marry My First Spouse?”

– Alan Snyder

April 19, 2021

“Swiss Cheese Diversification”

– Alan Snyder

January 4, 2021

“Much Portfolio Advice is Whackadoodle”

– Alan Snyder

September 17, 2020

“Between the Devil and the Deep Blue Sea”

– Alan Snyder

August 17, 2020

“Zombie Apocalypse”

– Alan Snyder

April 21, 2020

“Sic Transit Gloria – What Now?”

– Alan Snyder

March 25, 2020

“$7,000,000,000,000 in Hedge Funds and Alternatives”

– Alan Snyder

July 6, 2017

“We Are Not Retreating, We Are Advancing in a Different Direction”

– Alan Snyder

September 29, 2016

Press

Under the Term Sheets Podcast (Alan Snyder, Guest)

February 3, 2022

IVYFON – Alternative Credit (Panel) with Alan Snyder

September 14, 2021

Shinnecock Partners’ Key Insights to Guide Fine Art Lending for Investors and Fund Managers

Associated Press, March 4, 2021

The Joe Robert Show – Start Your Career Investing in Alternative Assets – An Interview with Alan Snyder

February 23, 2021

IVYFON – Art Lending in 2021 – Alan Snyder Interview

January 14, 2021

The Source Podcast: Evaluating Asset Managers with Alan Snyder, Shinnecock Partners (transcript/audio recording)

November 12, 2020

IVYFON October Podcast – Alan Snyder – Shinnecock Partners

October 12, 2020

Between the Devil and the Deep Blue Sea: A Discussion on the Economy, Finance, and Where to Invest!

August 28, 2020

CFA Society – PORTFOLIO Online-Private Credit

August 6, 2020

The Future of Specialty Finance Amidst COVID-19

iGlobalForum, June 4, 2020

Hedge Connection – In the Den with Lisa Vioni – Alan Snyder

April 24, 2020

Super-Rich Families Pour Into $787 Billion Private Debt Market

Bloomberg, December 9, 2019

Alan Snyder speaks to 700 investors at Gaining the Edge – New York Hedge Fund Conference

Alan Snyder speaks to 700 investors at Gaining the Edge – New York Hedge Fund Conference

November 4, 2019

Shinnecock Partners Launches Art Lending Portal

Press Release, September 19, 2019

How the Rich Get Spending Money: Locking Fine Art in Storage and Borrowing Against It

Los Angeles Times, August 1, 2019

Shinnecock Partners Launches Alternative Fine Art Lending Fund

Press Release, May 29, 2019

Family Office Pitches Art Loan Fund

Hedge Fund Alert, May 29, 2019

Investing in Art-Secured Lending

Investing in Art-Secured Lending

Art of the Times, Fall 2018

Commercial Lending Interview with Alan Snyder – Part 1 (audio recording)

The Commercial Investor Podcast, July 11, 2017

Commercial Lending Interview with Alan Snyder – Part 2 (audio recording)

The Commercial Investor Podcast, July 11, 2017

Beyond Wall Street Webinar Series: “Good Things Come in Small Packages,” an Interview with Alan Snyder (transcript/audio recording)

Arixa Capital, November 9, 2016

Share Your Secret Sauce! Alan Snyder Says Emerging Managers Should Provide More Details

John Lothian News (JLN), October 15, 2014

Looking Ahead to 2012

FINAlternatives, January 6, 2012

Q&A: Shinnecock Partners Head Bullish on Managed Futures

FINAlternatives, October 7, 2011

Lowering Volatility Through Managed Futures

The Wall Street Transcript, September 19, 2011

Musings from the Chicago CTA Expo

Great Pacific Wealth Management, September 15, 2011

Shinnecock Partners Honored by World Finance Magazine

Press Release, September 7, 2011

Shinnecock Named Best Managed Futures CTA Fund at World Finance Hedge Fund Awards

HedgeCo.net, August 30, 2011

“Behavioral Economics and Your Portfolio”

– Alan Snyder

Investment News, September 27, 2010

“Investing in Managed Futures”

– Alan Snyder

The Wall Street Transcript, June 28, 2010

Info/Contact